July/August 2014

Wisconsin Community Banker

19

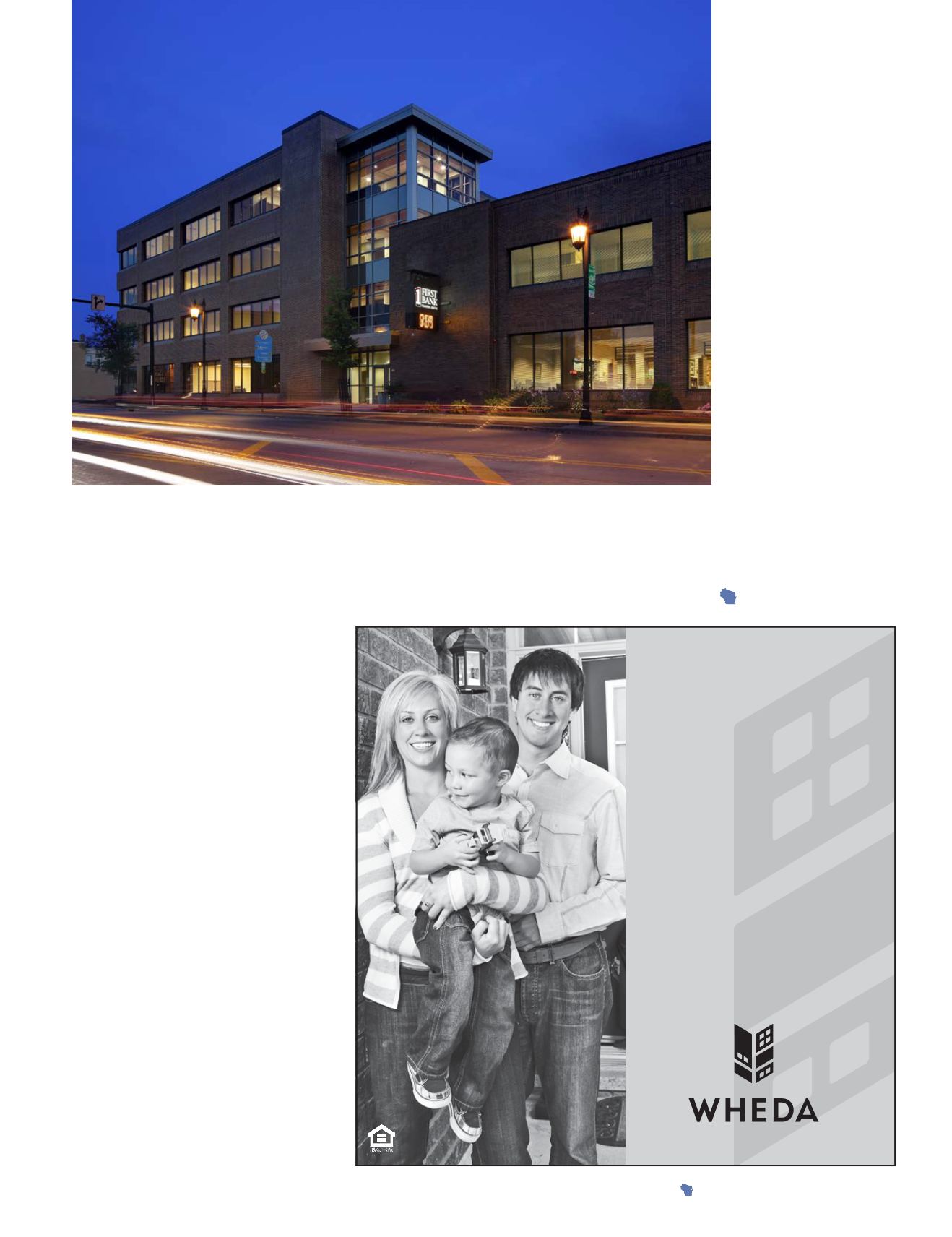

for future expansion.

Employee amenities,

such as an exercise

room, four oasis rooms

with beverage stations

and vending options, an

outdoor patio and an

expanded lunchroom,

are also part of the new

headquarters. An archi-

tectural glass tower with

expansive views of Lac

La Belle connects the

bank’s existing building

to the expansion.

Construction began

last June with demoli-

tion of a detached

drive through. The new

attached drive through

was re-sited to create

more parking and a bet-

ter traffic flow for cus-

tomers. It also provided

an open space where the headquarters

expansion is now located.

TWP Architecture and VJS

Construction Services led the

expansion.

the opening of its second Brookfield

branch at 12600 W. North Ave., bring-

ing its retail locations to 12.

Expansion Supports Teamwork

The headquarters expansion will

allow FBFC to bring all its corporate

employees back under one roof and

eliminate the need for “creative” office

space. Seven departments, including

the executive management team, qual-

ity assurance, marketing, commercial

lending, commercial processing, credit

analysis, and deposit operations, were

previously spread out among several

buildings.

“We really were bursting at the

seams. The larger space gives us the

opportunity to create a new, efficient

layout and workflow that fosters a cul-

ture of teamwork,” Mohr said. “It’s a

space that will serve us for many years

to come.”

Once the expansion is complete,

FBFC will be the largest building in

downtown Oconomowoc, taking

up a full block. According to Mohr,

staying in the center of the city was

imperative.

“Downtown Oconomowoc is going

through a revitalization and, as a com-

munity bank, we wanted to make sure

we contributed to that momentum

and economic growth.”

The expansion will house approxi-

mately 140 employees and includes

two open floor work areas, four con-

ference rooms, a multi-function meet-

ing and conference room, training

room, 15 offices, and three executive

suites, as well as an unfinished space

Down payment assistance.

With a

WHEDA ADvAntAgE

mortgage, your borrowers may qualify

for the

Easy Close Advantage

. This

down payment assistance loan has a

low-cost, fixed interest rate for 10 years

and is designed to help your borrowers

get into a home sooner with a

mortgage they can afford long-term.

Discover the WHEDA Advantage!

Income and loan limits apply. Certain

eligibility criteria may apply. Interest

rates are subject to change daily.

To learn more, go to

.

What is our

WhEDa

aDvantagE

®

?

800.334.6873

n